Practical and relevant learning materials

This course is packed full of advanced-level topics with immediate application for advice professionals. Learn the latest Behavioural Finance theory on how clients make important money decisions. Understand the regulatory landscape and obligations that financial advisers must operate within to comply with the law. Review and apply the ethical principles underpinning quality financial advice in Australia.

Ranked #1 Online University

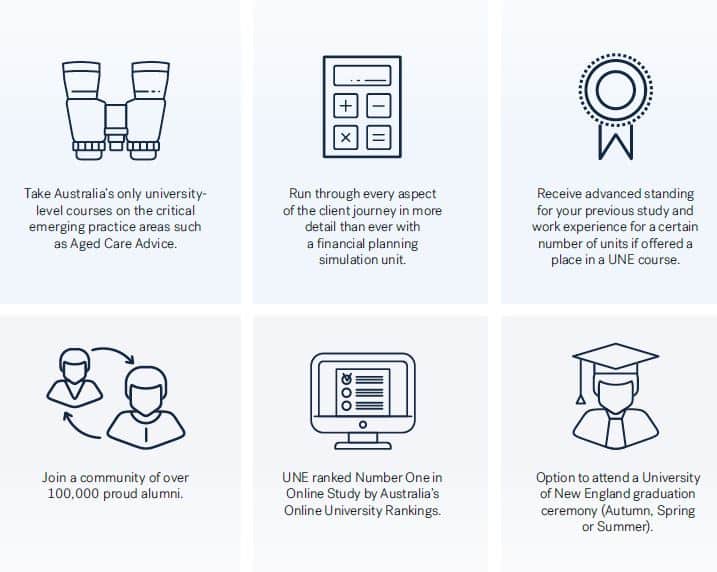

UNE has ranked number one in an online study by Australia’s Online University Rankings for the past seven years. Join a community of 100,000 proud alumni, that have studied at UNE, the ninth oldest of Australia’s 40 public universities.

FASEA approved

Existing Adviser pathway

UNE’s Bridging Course (Financial Planning) is specifically aimed at existing Financial Advisers* with previous specific qualifications that are eligible to complete it as part of the transition pathway leading up to 2024. This course has been approved by the Financial Adviser Standards.

Definition of Existing Advisers: ‘Existing advisers’ on the ASIC Financial Adviser Register prior to 1 January 2019 have a transition period until 2024 to meet the new education standards.

*The term “existing adviser” is set out in the Corporations Act under section 1546A. It is a person who is a relevant provider between 1 January 2016 and 1 January 2019 (except a person who has ceased to be a relevant provider). In layman’s terms, a relevant provider must be listed on the ASIC Financial Adviser Register. Existing financial advisers need to complete the FASEA exam by 2021, unlike new entrants that need to complete the exam prior to becoming licensed.

Study 100% online

Fit study around work, family and life. UNE’s course has been developed to give you absolute flexibility. And ‘online’ doesn’t mean ‘alone’. You’ll be backed by UNE’s expert lecturers and tutors when you require assistance.