Write an awesome business plan the easy way with these 14 essentials

If you’ve been thinking about starting your own business, the good news is it’s not impossible. People from all walks of life, including people like you, have been successfully planning businesses during this stressful time. In fact, that first step – writing a business plan – may be much easier than you think. We’ve prepared a neat lil’ template to help you get started with some structure. You could start working on your business plan while you’re furloughed, between jobs, on reduced hours, or just bored in your down time.

In this article we’ll show you how to fill out each section of your business plan template. It might look like a big task, but when you break it down into the smallest parts, you’ll see you can work on your plan and conquer it bit by bit. Got a spare five minutes? Great – that’s all you’ll need to draft up a great cover page, an inspiring vision statement, or a summary of your products/services.

Time to get excited about your business idea!

Before you start: the feasibility test

Before you get cracking on your business plan, it’s important to make sure your business idea is feasible. ‘Feasibility’ just means whether or not it’s possible, practical, achievable etc. In other words, is it doable, or is it doomed to fail?

IMPORTANT: if your idea doesn’t pass the feasibility test the first time round, don’t give up. It might pass with a few simple changes, like changing the scope of the business, the scale, the structure, the marketing, etc.

A ‘feasibility study’ can be a big thing, but it doesn’t have to be. You only need to answer a few questions to know whether it’s worth moving forward with your business planning. Some questions you’ll know the answer right away, some you may have to do a bit of research.

- Is it technically possible to provide this product/service?

- Is it legal?

- Are there enough supplies/stock/workers available?

- Is there a known method to produce the product/provide the service?

- Is it possible to break even (cover costs) in providing this product/service?

- Is it possible to pay wages (even just to yourself) when providing this product/service?

- Is it possible to make a profit (even small) from providing this product/service?

- Is there a proven demand for this product/service?

- Is there an existing market for this product/service?

- Is there any proof that similar businesses have been successful?

- Is there a lot of tough competition?

Pretty confident about feasibility? Then you can start gathering all the things you’ll need to write your plan.

Preparing for writing your business plan

To make things easier when you’re focusing and on a roll, it’s a good idea to gather all your information in one place. This means all the websites you’ve saved, spreadsheets you started, bits and pieces you’ve written, books you’ve read, sketches you’ve done, pictures of handwritten notes, etc. Digitise your resources where possible, and organise them somewhere secure, like a folder on your desktop, and back up on cloud-based storage (such as Google Drive).

Finding resources

No worries if you haven’t been thinking about a business long enough to have a collection of stuff yet. If you’ve got at least a general idea about what you want to do, it’s easy to start building a list of useful resources. Try finding each of these.

- Your state’s government small business services website

- Your local council’s small business services website (for local business)

- The regulator for your potential business (professional register, liquor licensing, etc.)

- An industry association for your potential business

- A news site covering your industry

- The ATO (tax office) business section

- A commercial real estate or subletting site (to keep an eye on potential locations)

- A book, blog or other publication by an entrepreneur or person in the industry that you admire

- Three businesses in the same general area (i.e. same trade, industry etc.)

- Three businesses you’d like to be like (success, style, etc.)

- Three successful similar businesses in the same area (i.e. same suburb or town for local businesses)

- Three potential suppliers

- On social media: three hashtags related to the product/service you plan to offer

- In your networks: three friends or acquaintances with relevant experience (starting a business, sales, marketing, legal, etc.)

Research what you don’t know

After going through the feasibility test and the list above, you might have some unanswered questions. That means you’ve got some research to do.

Make a list of things to research and tick them off one by one.

If you’re having trouble making a research list, here are some things to consider. IMPORTANT: everybody needs to consider these things. Do some research even if you think they don’t apply to you.

- What licenses and permits might be needed? (Start with ABLIS)

- Which laws and regulations might apply to the business? (for the industry, for the business regulation, for tax, etc.) (Start with these essentials)

- What kind of insurance might you need (and how much)?

- What are the biggest risks or threats for this kind of business? (more on this later)

- How much could it cost, minimum, to start this kind of business?

- What trends are emerging in the sector? (Start with Google Trends)

- What statistics exist on this industry – and what do the statistics tell you? (Try to find some ABS report series by searching for the industry)

- How do major players (listed companies) in the sector run their businesses (look at competitors’ reports on the ASX website)

- Check out any free market research reports available for your industry (start with IBISWorld)

Business plan title page

The title page is your first chance to make an impression on anyone else reading your business plan. It’s important the title page is free of errors, and laid out professionally.

A title page should contain these elements:

Name of the business

If you haven’t finalised and registered a name yet, put the working name (the name you’re currently using to refer to the business idea). Then finalise a name as soon as possible.

It’s important to make sure your business name isn’t already registered and trademarked by someone else. Check business name availability starting here, and trademarks here. NB: there are some words you won’t be able to include in your business name, including swear words and words that mislead people about the nature of the business.

Logo, colours and branding

If you’ve already started developing a logo for your business, it should go on the title page – even if you plan to refine it before launching. The logo says a lot to people about your business, so it’s a good idea to put it front and centre. If you’ve already skipped ahead and chosen colours and other visual branding elements, go ahead and include those too. Haven’t got a logo yet? Start looking at ideas now; you’ll get a better idea of what you want as you work through writing your business plan.

Owners

This is where you put your name, and the name/s of your business partner/s, if you have them. Include your best contact details (such as mobile phone number).

Address

If you already have a business premises lined up, put the address here. This includes work-from-home situations. If you don’t have a premises lined up but you know roughly where it will be, you can put the suburb or city, and update later.

ABN

You may already have an active ABN that applies if you’ve been doing contract or freelance work, and now want to do it full time. If you don’t have an ABN, it’s easy to apply for one. To make an application, you will need to have a number of different details ready to enter into the form, including the business name and address, legal structure, contact details, etc. If you’re not ready to do this yet, you can leave this blank, but you’ll need to get an ABN before you launch.

Executive summary

The point of the executive summary is to give a quick overview of everything in the business plan, so the reader can get a good idea of what they’re about to see. It’s called an executive summary because it’s made specifically to be short for executives who need information, but don’t have time to read long documents. The executive summary is your chance to impress readers such as potential business partners, investors, lending officers, and more.

A good executive summary should be one page or less. Although your business plan might be several pages long, you shouldn’t need too many words to sum up what you need to say. In fact, the shorter you can make your summary, the more likely you are to keep the reader’s attention.

Include a few sentences each on:

Products/services

Describe the products and/or services you will provide. If you don’t know the full range yet, describe the product/service category in as much detail as possible.

Market summary

Discuss the market for the products/services you will provide. Talk about the demographics of the local community if it’s a local business. Talk about the proven demand for the products/services; include statistics if you can. Most importantly, talk about how there is a demand that is not being met yet – and how your business will fill that need.

Vision statement

A vision statement is a sentence, or a couple of short sentences, on what you want to achieve with the business and why. Your vision statement should tell a reader about your goals (what you want to achieve with the business), your motivations, and your values. Think of it like a “where do you want to be in five years?” kind of answer.

Vision statements can be tricky because they’re part well-thought-out business goal, part personal feelings and ethics. However, it’s possible to be honest and businesslike at the same time. Try reading some ‘about us’ or ‘history’ pages on small businesses you admire; you’ll see owners talking about why they went in to business, or why they chose a particular niche.

If you’re having trouble kicking off your vision statement, try finishing one of these sentences:

-

- “We want to deliver the best possible (product/service) for (these people) so that they (kind of benefit for people/community).”

- “(Business name) will be the leading provider of (product/service) while having a positive impact on (social cause).”

- “(Business name) will change (issue/problem/need) by delivering outstanding (product/service).”

- “(Business name) will offer the best (product/service), with unique (characteristics; style, value, personalised experience, etc.).”

Owner experience

If you’ve got lots of great industry experience, including management experience, here’s your chance to impress the reader. Include everything that makes you (and your business partner/s) especially well qualified to run this business.

If you don’t have lots of high-level experience, you can use this section to talk about your other relevant experience. For example, you could talk about your experience as an employee or mid-level manager. If this is the case, make sure you mention how your business will fill gaps in expertise. This might mean mentioning any mentors, expert consultants, or advisers you have (or will be able to get access to).

Financial summary

There’s a lot that goes in to the financial plan section of your business plan. But there are a few key details you should be able to sum up quickly, to include in the executive summary. Consider including:

-

- Estimated start-up costs

- Sources of finance (own money, investors, borrowing, etc.)

- Projected income/profit for the first year (or as long as you’ve done the projections for)

Business description

This section is where you talk about all the other things that make up your business, besides the actual products/services you sell. This can mean everything from the structure of the business, to the way you sell and distribute, to the location. Make sure you include:

Legal structure of the business

There are four common types of business structures in Australia. The business structure you choose depends on your needs and circumstances. The business structure can determine the licenses you need, how much tax you pay, how much paperwork you have to do, how much control you have, your personal liability, and more.

You may need to speak to a professional, such as an accountant or lawyer, to work out which one is right for you. NB: you may start off as a sole trader and move on to incorporate (become a company), or go in to partnership with someone/others.

Sole trader

A sole trader is the simplest form of business. It is relatively easy to set up. Sole traders are responsible for all aspects of the business, including day to day decisions, debts and losses. Sole traders use their individual tax file number (TFN) to lodge tax returns. Sole traders can hire people as employees, but statistically, most go it alone.

Company

Unlike sole traders and partnerships, a company is a legal entity that is separate from its owners and employees. A company can incur debt, sue and be sued, just like a person.

Companies may be more expensive and complicated to set up, and most companies have to do at least annual paperwork. On the up side, setting up as a company can mean limited liability and a lower tax rate (on company profits – anything you pay yourself or your employees is still at the marginal rate).

Partnership

A partnership is a structure where two or more people share income, losses and responsibilities. Like sole traders, partnerships are relatively easy to set up, and there’s minimal paperwork. They must, however, have separate tax file numbers, and an ABN.

Trust

A trust is a special legal arrangement where the business is run for the benefit of others, known as beneficiaries. The trustee can be a company. Some family businesses are trusts. Trusts can be expensive to set up and operate, as they require specialist help to establish, and formal yearly administrative tasks.

Type of business

Here’s where you answer questions such as:

- Will you sell to consumers (B2C), businesses (B2B), or both?

- Will you operate a wholesale or retail business?

- Are you manufacturing anything?

- Is this a product business, a service business, or a bit of both?

- Will you sell online, in a real store, or both?

Size of business

Most people starting a business will be starting a micro business or a small business.

A microbusiness is one person.

A small business is between one and 50 employees (ASIC purposes), under $10 million turnover (ATO purposes), under 15 employees (Fair Work purposes), or under 20 employees (ABS purposes).

A medium sized business is between a small business (any of the above limits) and a large business.

A large business is one with turnover of more than $250 million (ATO purposes), $50 million turnover/$25 million assets/100+ employees (two or more of those, for ASIC purposes), or 200+ employees (ABS purposes).

History

Many businesses won’t have a history, per se. But a section on history might be necessary if:

- You’re taking over an existing business

- The business will be a collection of individuals (partners or co-owners) with significant history together

- You’re going to operate from historic premises, such as an old building with important heritage

- You are turning an unofficial operation into an organised business

Location

Location is particularly important if you’re thinking of starting a business in a particular local area, serving local customers (think: café, grocery store, etc.). In the location section, talk about aspects of your potential business location that will affect the success of the business or the way you do business. This may include:

- Characteristics of the neighbourhood

- Potential foot traffic

- Nearby parking or public transport

- Development activity in the area

- Changing demographics of the neighbourhood

Values

Depending on the type of business you are planning, it may be particularly important to talk about your values. This means the things that are important to your business; its priorities, and the principles you use to make business decisions. This could include:

- Sourcing local ingredients/supplies

- Prioritising quality

- Prioritising price

- Choosing retailers or business partners with particular characteristics

- Providing extra competitive wages and conditions

- Corporate social responsibility:

- Environmental protection

- Waste reduction

- Engaging with the local community

- Supporting charity/non profits

- Supporting social causes

Products and/or services

In this section, you can go in to more detail on the products or services (or both) that you plan to offer. This doesn’t just mean including a menu of services, or a list of core products (although it can if you like). You can also cover:

Further description of products/services if needed

Are your products or services new, unique, or highly specialised? For an average reader of your business plan, you might need to include more details so they understand what you’re going to be selling. Talk about the features, benefits, and purpose of each product or service.

Unique selling propositions

This might be one of the most important parts of your business plan, so it’s worth spending some extra time on. The unique selling propositions (also unique selling points, or USPs) are the things that really make your business stand out. In other words:

-

- What will you do, that your customers want, that nobody else can do?

- What will you do better than anyone else?

- What makes your products/services different to others?

- What makes your products/services more appealing to your target market than others?

It’s important to be really critical with yourself here. How much does your business idea really stand out from others? If you can’t think of many meaningful USPs, you might have to develop some. Think of ways you can make your business stand out, based on things you know your customers want.

Luxury or necessity?

Many aspects of the way you plan your business will depend on whether your product is a luxury, a necessity, or a bit of both (like a luxury version of a necessary product). From the way you differentiate your business, to the way you stand out of the crowd, to your financial strengths and weaknesses – each of these can change depending on whether your product/service is a must-have, a special occasion treat, or something that’s only a regular purchase for wealthier customers. You don’t need to write much on whether your product is a luxury or not; just make sure it’s covered somewhere if you don’t think it’s already obvious.

Anticipated demand

As part of your market analysis (the next section), you’ll be looking for proof that there is a demand for what you’re going to be selling. It may help to discuss the anticipated demand in the section on products and services as well. For example, you could talk about which you think will be your most popular products/services, and why.

Suppliers/contractors

It’s important to identify suppliers, and backup suppliers, before you start doing business. In general, you should have a strong awareness of the different suppliers that are available to your business, how hard it is to secure suppliers, the amount of bargaining power you’ll have with suppliers, and so on. In this section, talk about your preferred suppliers, why you chose them, and how you would go about finding alternative suppliers if needed. This also applies to service businesses which don’t have many inputs or consumables; for example, what would you do if you needed to find new staff, consultants, subcontractors etc.?

Market analysis

A market analysis is a detailed investigation and explanation of who might buy your product/service, when, where, why, and for how much. It’s important to do a thorough market analysis because even if you think you’ve got a good idea of your potential customers, the statistics you discover might surprise you.

Try researching and including the following in your market analysis.

SWOT analysis

When you’re thinking about your potential business, it’s easy to focus inwards. But if you want to be successful, your plan needs to consider the competition and the general environment you’re going to be operating in. One of the best ways to do this is with a SWOT analysis.

SWOT stands for ‘strengths, weaknesses, opportunities (and) threats’. It’s a way to look at all the things that could go right and all the things that could go wrong with the business, including things that are within your control, and things that are not.

Add dot points to each section. You should be able to think of at least a few things for each section. If you’re having trouble, remember:

- Strengths are internal things that are positive for the business, like your USPs.

- Weaknesses are internal things that are negative for the business, like expertise and experience you are lacking.

- Opportunities are external positive possibilities, like underserved markets or areas with few competitors.

- Threats are external negative possibilities, like changing regulation or economic conditions.

Target market (people)

Describe your potential customers in as much detail as possible. It’s not good enough to just say ‘everyone’; you’ve got to be specific if you want your plans to be effective.

If you are planning a business that will sell to other businesses, you can still complete the following, but by describing businesses instead of individual people.

Consider:

Total market

What is the total number of people who could potentially become customers? Think: all the people who could possibly want or need the product, and afford it, and be able to access/buy it.

Segments

How would you break up your total market into groups with similar characteristics? Would you group potential customers by age, location, income, personal characteristics, reason for buying, or a combination of different things?

Choosing a target market

Which of the segments will you focus on the most, and why? Think about which segments are most likely to spend the most, buy/visit the most often, and be the most loyal customers.

Describing the target market: consumer profiles

Write a profile of an imaginary consumer from the target market/s you have chosen. Include all the details you have already worked out, like the things you decided to segment on. Then research other important things related to people with those characteristics, such as their shopping habits, what they like to do with their spare time, their aesthetic preferences, etc. If you’re having trouble coming up with a profile, imagine your ‘ideal customer’: the perfect customer you’d want to attract and keep.

Market needs

‘Market needs’ is another way to say ‘gap in the market’ or ‘niche’. In other words, it’s a thing that people want, that isn’t currently available. Generally, businesses are successful when they identify and meet market needs.

You may write a separate section on market needs if you feel you still have something to say after covering products/services and the market analysis. For example, you might want to round out your description of the unique spot your product/service will fill.

Competition

It’s important to have thorough knowledge of your competition before you go in to business. This way you can effectively plan to compete and beat them on several different fronts.

Research and describe your competitors. If you’re planning to operate a highly specialised business, you may be able to name specific businesses you will be competing against. If not, it’s OK to describe a general group of competitors, and name just a few examples. Make sure you cover:

Major players

Businesses that are much bigger and more established than yours, but which you still compete with in some way. This includes businesses you’d like to emulate one day.

Direct competition

Businesses that are very similar to yours, offering the same kind of product, service, experience, solution etc.

Indirect competition

Businesses doing the same thing as you but in a different area, or offering a significantly different product or service but with some clashes.

Barriers to entry

If you haven’t already (in the SWOT), this is where you cover the hurdles you’ll have to get over to start your business. This may include things like:

- Needing to get a particular license or registration (including one that’s limited, or not guaranteed to get approved)

- Having to wait a long time for regulatory inspection/approval

- Technology challenges: internet not fast enough, software not available, etc.

- Significant start-up costs: expensive equipment, lots of stock, etc.

- Exclusive distribution: businesses may be under contract to only sell certain brands or use certain suppliers.

IMPORTANT: Every time you list a barrier to entry, you should describe what you plan to do to overcome it. For example, you could talk about how you plan to pay for things while you’re waiting for a license or permit to come through.

Regulation and licensing

If you haven’t already covered regulation and licensing, this is a good spot to include them. Go back to the resources and research you did at the very start on the laws and licenses that may apply to your business. Make a list of the licenses you will need to obtain before starting to operate, including the application costs and information necessary for the paperwork. For example, if you’re planning to open a bar, talk about liquor licensing in your state/territory.

Marketing plan

Now that you have analysed the market you will be serving, you can start to sketch out a marketing plan. It’s common to have a more comprehensive marketing plan as a separate document, especially once you’ve launched the business, but you can still start to sketch out the basics as part of your business plan.

Marketing goals

What do you want to achieve with your marketing activities and efforts? It’s important to set goals so you can see whether the things you’re doing to market your business are worth the time and money you’re putting in. Think about goals like:

- Making people from your target market aware of your product/service

- Gaining social media followers from your target market

- Getting people to consider buying your product

- Convincing people to take the final step and pay for your product/service

Make your goal as specific as possible. For example, you might aim for:

- A certain number of sales

- A certain sales value ($ per transaction)

- A particular percentage growth (%) in customers

- A set number of followers

- A set number of website visitors

Remember, your marketing goals should ALWAYS be related to your business/strategy goals. This means you need to work out how many sales you need for your business to be successful. Work back from there to find out how many website/store visitors you need, then how many people you need to see your ad/shop front, etc.

The four Ps of marketing

The four Ps of marketing are the four basic things you can control to influence how marketable and successful your business is. They are:

Product

Your ‘product’ might seem obvious, but there are ways you can change the product to influence whether the customer buys or not, or how much they spend. Product changes can include anything from bundles and special deals to customisation options and add-ons.

Price

Your prices will be determined by your costs, and your need to break even and make a profit. But they can also be influenced by your competitors’ prices, and the image you’re trying to promote. For example, you may price your products/services a little higher if you’re trying to frame them as ‘luxury’.

Place

‘Place’ means the location where your product or service is sold. This might mean retail partners, your online store, your business premises (or lack thereof if you’re mobile), etc. These days, many transactions are at least started online, so it’s important to think about your online presence when considering place.

Promotion

‘Promotion’ means everything you’ll do to make your potential customers aware of your product/service, convince them to buy, convince them to spend more, and convince them to keep coming back. Promotional activities may include (but are certainly not limited to):

- Traditional advertising (newspapers, billboards, radio etc.)

- Flyers, postcards and catalogues

- Online advertising (social media, banner ads, email advertising etc.)

- Samples and free trials

- Trade fairs

- Coupons and special offers

Key strategies

What are the top two or three marketing activities you will start with? Think about things that will make people aware of your business and what it does as quickly as possible. This could be anything from search engine optimisation for your website, to using social media influencers, to local letterbox advertising. You can then refine your strategies or add to them over time as you get more data on what really works for your business.

Make sure your key strategies reflect your target market. Think about where your target market will be looking and spending their free time, whether that’s online and in real life. For example, it’s not much use advertising on social media if people in your target market don’t really use social media.

Budget and timeline

Thinking about your marketing budget and schedule is particularly important when you’re just starting up. Chances are you’ll have to do a lot of marketing activities at the very beginning just to get established and make people aware of your business.

To create a basic budget and timeline:

- Work out your financial goals, which then lead to your marketing goals.

- Set a deadline to work towards. This could be anything from three months (the next quarter) to your first year of business, depending on your financial needs and how much time you’re putting in to the business.

- List the activities you think you will need to do to reach the goals by the deadline.

- Research the costs of doing those activities (quotes or estimates are OK).

- Put the activities (and associated costs) in priority order on the timeline. For example, you might start with your website or social media presence, then add in advertising, etc.

Management team

Unless you’re going in to business as a sole trader, chances are you’ll have some decisions to make about who else is going to be involved in the success of your business. Who are you going to choose to lead and manage the day to day operations? Who are your key people going to be?

If you already know who you’re going to employ or partner with, list their details here. Make sure you cover:

- Owner/s

- Top-level managers (general manager, CEO etc.)

- Senior managers (team leaders, supervisors etc.)

- Consultants/experts: coaches, mentors, legal, accounting, etc.

Talk about each person’s qualifications, experiences and strengths. Bonus points if they have proven experience in helping to establish successful similar businesses. List each person’s responsibilities and key tasks within the business.

If you’re not sure who you’re going to employ, this section is where you write the positions that need to be filled. Include a summary of:

- Positions that need to be filled: different jobs/roles within the business

- Position descriptions for each job (qualifications, responsibilities, etc.)

- Competitive salary and conditions for each position (look up any minimum wages that may apply, plus other things your competitors are offering to attract the best workers)

Operations plan

Like with marketing, it’s common to have an operations plan document that’s separate from the main business plan. It’s still important to cover a few basics of your operations in your business plan, so readers will understand how your business will work to day.

Your operations plan should mention:

Suppliers

Even if you’ve already discussed suppliers under another heading, list or describe them again here. This includes suppliers for everything from your ingredients, stock or supplies to your office consumables, phones and internet etc.

Equipment

No matter what products or services your business sells, chances are you’ll need to invest in some equipment. This could include anything from machinery and vehicles to tools, computers, desks and other office equipment.

Trading hours

What hours will your business be open? What hours will you be available for customers/clients to contact you? Think about your potential trading hours, based on your business goals, your competitors, and your customers’ expectations. You can balance your trading hours between customer convenience, and your own needs. For example, you may have a 24/7 online presence, but only be in your store/office five days a week.

Communications

How will customers be able to contact you? How will you keep in touch with customers to inform them of changes to the business, or for marketing purposes? Describe the channels of communication you will offer, including:

- Website

- Landline

- Mobile phone

- In-store/office

- Social media

- Online chat

Talk about which channels of communication you will use and why.

Quality control

How will you make sure you maintain a high level of quality in your products and services? What policies and procedures will you put in place? Think about the things you will do to make sure you keep up the quality standards you set. This could include anything from inspecting stock before it is offered for sale, to observing staff delivering services (or getting customer feedback), to getting an outside auditor to help.

Payment and credit policies

How will customers be able to pay for products/services? Will you offer cash, card payments, lay-by, cash on delivery, or special payment services? If you’re selling to other businesses, will you offer credit terms? If so, how long will you give people to pay? Again, it’s important to think about your business needs, your customers’ expectations, and what your competitors are offering.

Note that some payment services have fees and charges attached. For example, it costs money to have an EFTPOS terminal in a store, and the bank charges fees for each transaction. Online payment services like PayPal and Afterpay may charge a fee (flat fee or a percentage of each purchase) that you need to consider. If you’re worried about this, remember you can always start with one or two basic payment options, and add more later.

Risk management

Countless small businesses fail every year because they don’t take the time to consider, evaluate and plan for all the risks they face. It’s pretty simple; by planning ahead for things that could go wrong, you can prevent them, or take action to make things right. Potential investors or lenders in particular will want to know your risk management plans, so they can be sure their money is in good hands. Insurers may also need information on your risk management plans, so they can personalise your quote.

The basics of a risk management plan are:

Risk register

A risk register is basically a list of all the risks your business faces, both internal and external, in your control and not in your control. In other words, it’s a list of all the things that can go wrong. Risk registers are usually presented as tables, but you may start with a dot point list.

It’s important to be honest and thorough in investigating potential risks. Think about things that have gone wrong with other organisations, or similar businesses. This could mean anything from workplace injuries, to supply chain interruptions, to natural disasters. If you’re having trouble thinking of things, Google ‘business risk examples’ to get you started. Use the resources you found at the start to help you identify industry-specific risks.

The point of a risk register isn’t to scare you or put you off going in to business. Rather, it’s to help you get prepared, so you feel confident and organised.

You can make your risk register a separate document and add to it over time after you launch, as you learn more about the risks that are unique to your business.

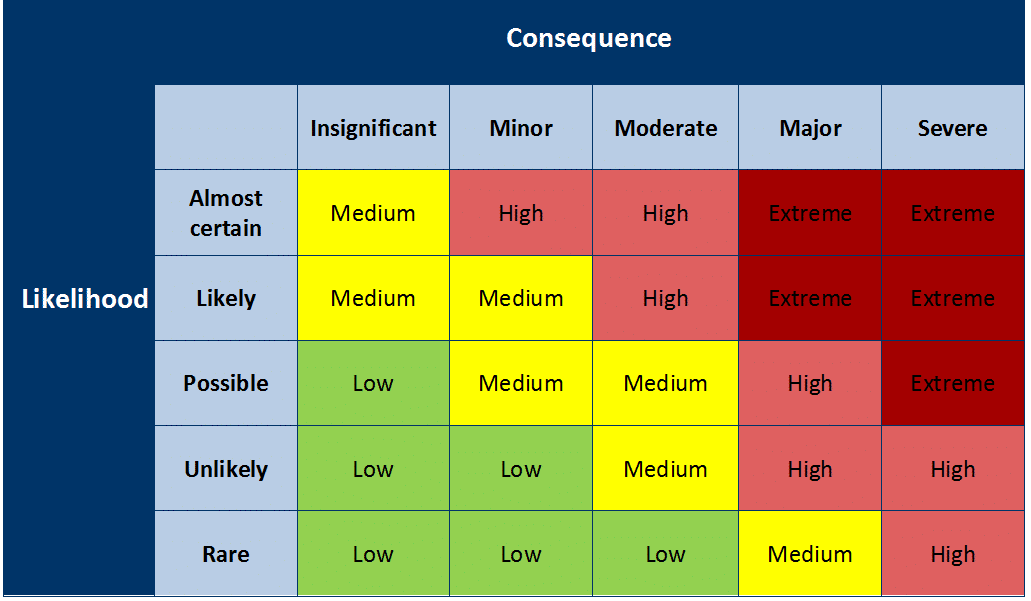

A risk matrix

A risk matrix is a chart where you compare and analyse the likelihood of something happening, with the consequence of it happening. The matrix is used to help you work out which risks to focus on, what to do, and how much time to spend on them. The things that are unlikely and low impact are the things you give the least attention to, and vice versa.

Source: University of Melbourne

Give each of your risks on your register a rating/colour code depending on where they sit on the matrix.

Risk management plans

Starting with the most serious/likely risk, for each risk on your register, write what you will do to a) prevent and b) recover from the event. For example, for safety risks, prevention measures could include safety equipment, policies and procedures, and audits. For supply chain interruptions, prevention measures could include maintaining stock/supply levels, or having alternative couriers to turn to. For accidents and natural disasters, your management plans could include anything from insurance to cloud back-ups of all your documents.

Finances

Your financial plan is one of the most important parts of your business plan. It sounds basic, but many people fail to plan for all the expenses they will need to cover to start their business and keep it running while they build up a customer base. Some people forget certain start up costs, or overestimate how many sales they’ll be able to make at the very beginning. In general, it’s good to be conservative with your financial plans. Give yourself as much of a start-up budget as possible, and be modest about your projected sales.

Your financial plan should cover:

Start-up costs

Make a list of once-off costs you’ll have to pay to get up and running. This could include things like:

- Purchase of premises

- Purchase of essential equipment

- Upfront rental payments

- Development, refurbishment or fitout costs

- One-off registration fees or license fees

- Initial stock and supplies

- Marketing to get started, including any launch events and publicity

Fixed regular expenses

Make a list of expenses that will come up every month, regardless of how high or low sales are, including:

- Rent, body corp or maintenance fees

- Salaries for permanent staff

- Utilities (electricity, phone, internet etc.)

- Insurance

Variable expenses

Make a list of expenses that will change depending on how busy or successful the business is, and estimate the cost per month for the first year of business. Include things like:

- Wages for part-time, contract and casual staff

- Stock, supplies and consumables

- Marketing activities

Projections

A projection is a prediction of how much money you will make for the first year or so of business. Projections can be based on a range of information, including (but not limited to):

- Financial information from similar businesses

- Industry standards

- Pre-sales or pre-orders

- Expressions of interest

- Market analysis plus planned prices

Include as much detail as you can gather on what you expect your sales to be for each month of the first year. Explain how you came to those numbers. Compare projected sales with the monthly expenses you have calculated to come up with projected profit or loss each month for the first year.

If your projections show you will be making a loss to start with, don’t give up. In some industries, it’s standard for businesses to make a loss for a significant time while they get going. You may need to adjust some parts of your plan, or start with more money to cover your costs until you break even.

Cash flow plan

‘Cash flow’ means the money going into and out of a business. It is also referred to as liquidity. It’s important to have good cash flow so you can pay your expenses (including taxes, bills and salaries), and hopefully draw a profit from the business as well.

A cash flow plan is simply a plan for making sure that enough money is coming in to the business’s accounts, as often as possible. Cash flow plans can vary a lot depending on the type of business you’re running. For example, it might include plans for:

- Getting clients to pay their overdue bills

- Having promotions or special events when sales are low

- Using a facility at the bank, such as an overdraft or credit card

Financing needs

At the most basic level, your ‘financing needs’ are the difference between your total start-up costs and the money you’ve already got in the bank. If you’re starting a small business or micro-business with low start-up costs, your financing needs might be zero. If not, it’s time to look at how much money you need, and where it might come from.

Depending on the business you’re starting, financing can come from one or more of:

- Banks

- Other lenders

- Investors

- Grant programs

Use this section of your business plan to explore all the financing options available to you, and put them in preference order.

Appendices

There may be things that you want to include along with the business plan for readers’ benefit, but which don’t belong in the main business plan document. This could include things like:

- Product/service/premises photographs• Reference images

- Video links

- Charts

- Reports

- Independent analyses

- Letters of support

- Expert opinions

- Audit reports

- Source links and general information links

Include these at the very end, in a separate section labelled ‘appendix’ or ‘attachments’. Make sure everything is labelled or captioned, and well organised.

–

If you’ve made it to the end of this business planning guide, and filled out your business plan template, congratulations! You’re on your way to launching a successful business. If you’re still feeling unsure of some things, or if you’ve realised just how much you still have to learn, consider studying one of our courses.

First? download your free business plan template here.

Monarch Institute offers a number of different business, marketing and bookkeeping courses to fit your needs as a potential small business owner. All the courses are 100% online, so you can study at your own pace and fit learning around your current work and personal commitments. The trainers are all successful business people with plenty of experience and guidance to share.

Explore the course pages today, and if you’re still unsure of which course would suit you best, get in touch with one of our friendly Course Consultants.